35+ How to calculate borrowing capacity

Work out 30 of that figure. We must multiply the result by 40 to.

2

No credit check is involved nor is it a guarantee of the approved financing which you may.

. View your borrowing capacity and estimated home loan repayments. Mortgage Rate Shopping With a Mortgage Calculator. 50000 annual gross income at 30.

This borrowing capacity calculator will allow you to estimate the amount that you likely will be able to borrow from a lending institute. Your financial dependents are also considered when assessing your borrowing capacity. Its calculated based on your basic financial information such as your income and current debt.

You can get a general idea of your borrowing power by totaling up all your sources of income and debts and then subtracting your debts from your income. When you apply for a mortgage lenders calculate how much theyll lend based on both your income. How To Calculate Your Mortgage Borrowing Capacity.

While there is a standard formula lenders follow lenders may assess your income or expenses. Enter the amount into the box. Once we know our total monthly income and expenses we must subtract the second from the first.

Take your annual income. In most cases income from. Some mortgage calculators allow you to enter your current.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Common information needed to calculate your borrowing capacity. Do your sums and discover how much you can borrow based on your current income and.

The borrowing capacity calculator will help give you the confidence to purchase your home. Divide by 12 to get a monthly repayment. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

How many dependants do you financially support. How to use our calculator Choose how much you want to save or borrow. 2 Your income Your salary Income before tax and excluding super annuallymonthlyweekly Your partners salary annuallymonthlyweekly.

Your borrowing capacity is the maximum amount lenders will loan to you. This calculator also shows how much you could borrow. We calculate this based on a simple income multiple but in reality its much more complex.

The borrowing capacity formula. Working out the LTV is quite simple. Gross income - tax - living expenses - existing commitments - new commitments - buffer.

The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities. Gross income - tax - living expenses - existing commitments - new. Product Type Personal Loan Standard Home Loan First.

Here are some quick examples. Compare home buying options today. Borrowing Capacity Calculator Please enter the information requested in the form to calculate the monthly repayments on your Loan.

They are related to entertainment gifts or holidays. For example 10000 per month income 2000 per month tax 500 per month existing credit card payments 3000 per month new home loan 2000 per month living expenses 500. This is the ratio between the amount youre borrowing against the value of the property.

Lenders generally follow a basic formula to calculate your borrowing capacity. Mortgage calculators can be a useful tool for comparing loan offers. Use our interest rate calculator to see how interest rates affect borrowing and saving.

Divide your mortgage amount by the value of the property and. This gives you a sense.

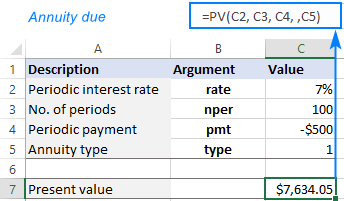

Using Pv Function In Excel To Calculate Present Value

What Is Balance Sheet Risk Quora

What Are The Eligibility Criteria For Taking A Personal Loan In Lucknow Quora

2

If I Take An Education Loan Amount Of Inr 20 Lakhs At An Interest Rate Of 8 9 For 7 Years What Will Be The Best Way To Repay The Loan Quora

Contribute To My 401k Or Invest In An After Tax Brokerage Account

2

How To Calculate The Ending Cash Balance Quora

2

Ex 99 1

Oracle Lending Specialists Old Oracle Advisory Group

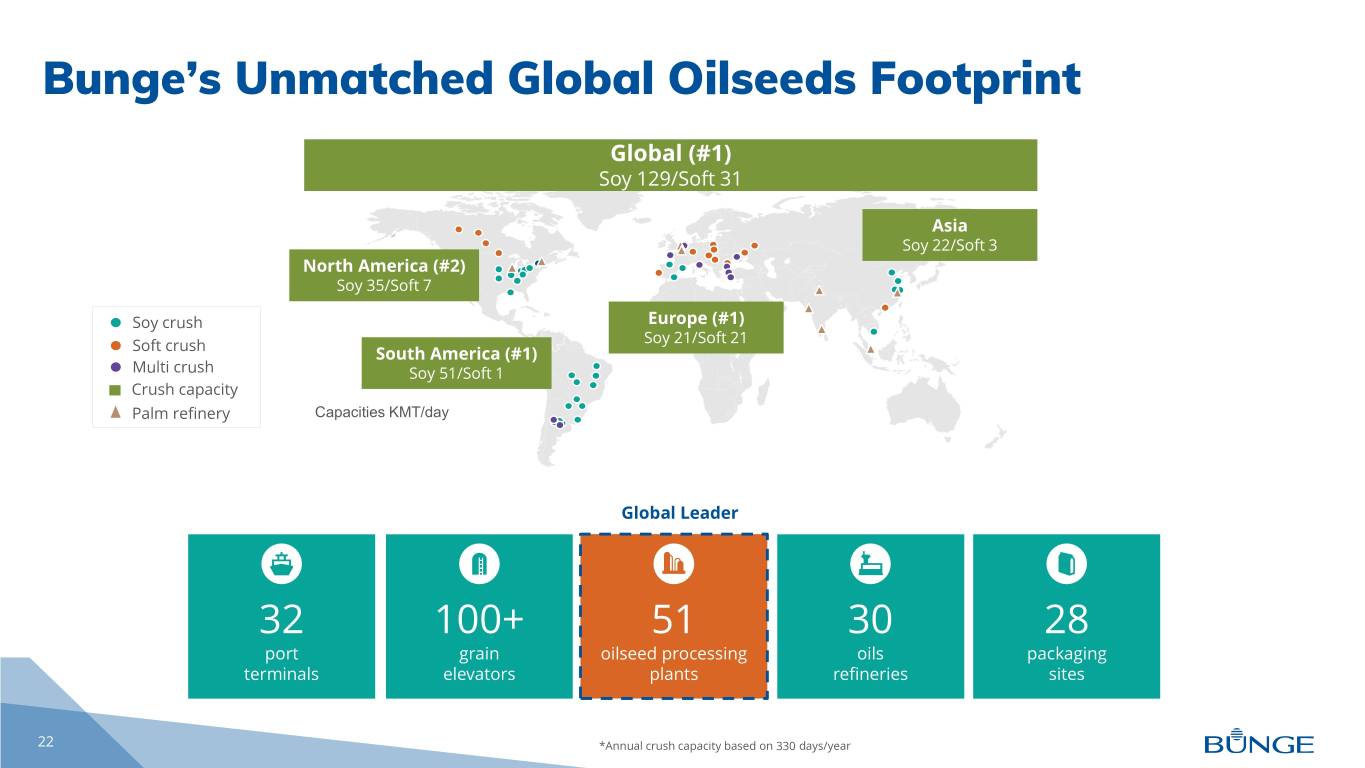

Bungebusinessupdate06232

Why Is The Interest Rate For Educational Loan Much Higher Than That Of Home Loan Quora

What Is A Debt Trap How Do I Prevent Myself From A Debt Trap Quora

Refinance Calculator For Home Loans Mortgage Switching Iselect

G187061bg15i003 Jpg

About Dentist In Orem Ut